Beyond Industrial and Logistics

As part of the BNP Paribas Group, we offer our clients the unique advantage of seamless access to a global banking network. This connectivity enhances our ability to provide cross-border insight and unlock international capital. Unlike stand-alone firms, our integration with one of the world's largest financial institutions enables us to support clients on both a local and global scale - offering a truly comprehensive and strategic approach and providing different types of opportunities.

GLOBAL KNOWLEDGE, LOCAL EXPERTISE

Our reach spans major logistics corridors and urban hubs, leveraging both deep local expertise and the global knowledge of BNP Paribas to deliver tailored insights for your properties.

SUSTAINABILITY

Sustainability is a core component of our advisory work. We help our client’s future-proof their assets through smart design, energy efficiency, and alignment with ESG goals. Whether it’s urban logistics, temperature-controlled storage, or cross-dock facilities, we provide practical solutions that work today and add value tomorrow.

INTERNATIONAL INVESTOR NETWORK

We deliver a fully integrated worldwide platform, tailored to the industrial and logistics sector. Our team advices national and international clients on, acquisition, sale, development, and repositioning of logistics and industrial assets.

Our Expertise

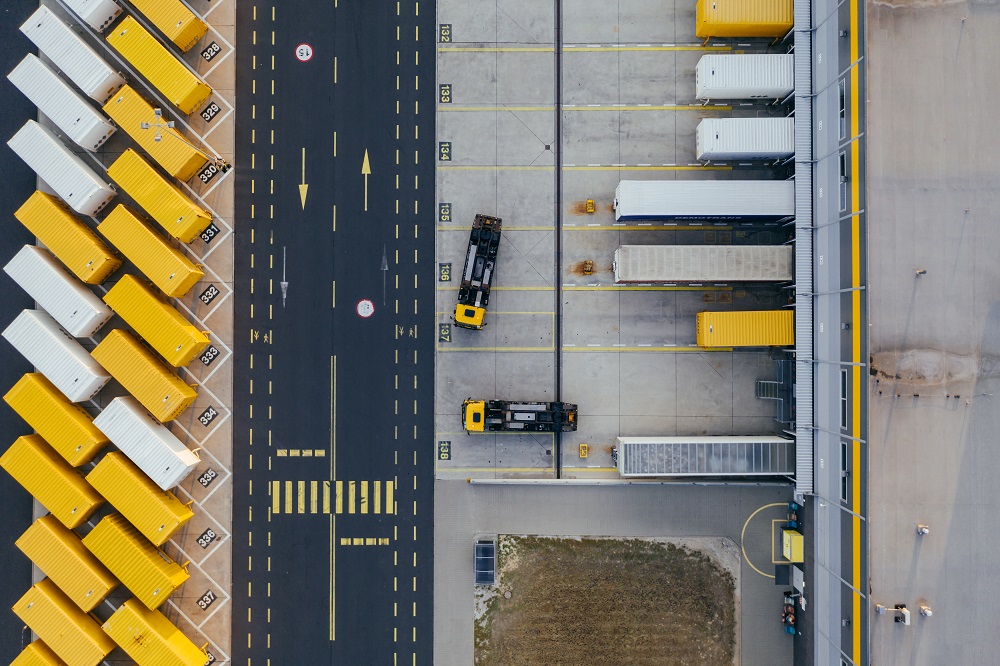

From the rise of e-commerce and same-day delivery to increased automation and the drive toward sustainability, the landscape is changing and so are the demands on logistics real estate.

With a stock of now over 160 million sq m, the industrial and logistics sector has been evolving at an unprecedented pace and became the leading asset class in capital markets. At BNP Paribas Real Estate Netherlands, we support occupiers, developers, and investors in navigating this transformation. Whether it’s acquiring or selling large-scale distribution centers, optimizing your last-mile footprint or developing future-proof logistics hubs, we are your strategic partner in every phase of the process. Logistics assets are essential components of the supply chain, a company’s operational efficiency and customer promise. That is why our approach is rooted in deep market insight, cross-sector expertise, and a forward-looking mindset.

To help visualize our capabilities, here’s a snapshot of what defines our Industrial & Logistics service line:

- Nationwide coverage with deep local market knowledge

- Strategic advice for occupiers, developers, and investors

- A-Z Transaction support in acquisition, disposal and Sale and Leaseback transactions

- Expertise in industrial, logistics, coldstore, last-mile and cross-dock property

- Strong network across institutional investors, local investors, developers and owner

- Advisory on ESG and future-proof logistics design

- Support with zoning, permitting, and (re)development strategy

- Market access to both core, core+ and value-add opportunities

Services

Consultancy

For occupiers, we provide consultancy solutions that help to align their strategies an ambitious for business growth with housing. We assist in location selection, lease negotiations, and build-to-suit developments. For investors, we offer market intelligence, access to off-market opportunities, and end-to-end transaction support—from acquisition to exit. Developers benefit from our strong network of tenants and investors, as well as our ability to position assets in line with emerging market trends and opportunities.

Sale and Leaseback

As part of our capital markets services, BNP Paribas Real Estate Netherlands also offers guidance in ‘sale-and-leaseback’ processes. A sale-and-leaseback is a transaction in which you sell the property to an investor and immediately lease it back at your preferred lease-back terms. After a sale and-leaseback transaction, you as the seller continues to use your property for business operations. By leasing the property on a triple-net basis, you secure long-term non-reliance on a landlord and can continue your operation in the property.

Advantages of a S&LB transaction include:

-

Additional liquidity to be invested in day-to-day operations,

-

Improved balance sheet positioning,

-

Less risks (decreased lender dependence), and more returns on other investments.

Over the past few years BNP Paribas Real Estate’s broader transaction team has already assisted in more than €650 Mn and approx. 600,000 sqm of transactions and thus offers the right experience and expertise for success. Our track record is broad and ranges from smaller regional deals to large XXL projects of multinationals.

Get in touch with us

Whatever your needs, our expert advisors are here to guide you with strategic guidance and industry-leading expertise.